EU Beet Pulp Market Grows Toward USD 120.5 Million by 2035, Driven by Sustainable Livestock Feed Adoption

The European beet pulp market is set to expand steadily, driven by rising demand in animal feed and sustainable agricultural practices.

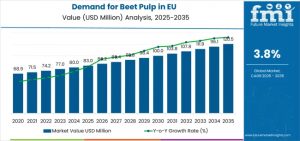

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- The European Union beet pulp industry is entering a decade of sustained expansion, supported by Europe’s accelerating shift toward sustainable animal nutrition and circular economy practices. According to the latest industry assessment, the EU beet pulp market is projected to increase from USD 83 million in 2025 to USD 120.5 million by 2035, advancing at a 3.8% CAGR. Demand is being fueled by rising dairy output, adoption of cost-efficient feed formulations, and intensified utilization of sugar processing byproducts.

Quick Market Highlights (EU, 2025–2035)

• Market value growth from USD 83M → USD 120.5M

• Dried pulp (pellets and shreds) holds 45.6% share in 2025

• Cow feed application captures 56.0% of total demand

• Germany, France, and the Netherlands lead growth

• Market size will expand 1.45X by 2035

Demand Outlook: EU Beet Pulp to Add USD 37.5 Million in Value by 2035

EU demand is forecast to add a total of USD 37.5 million in new market value between 2025 and 2035.

• 2025–2030: Sales rise from USD 83M → USD 96.6M, accounting for 45.5% of total decade growth

This early-period growth is driven by dairy farmers shifting toward fiber-rich, digestible feed ingredients that improve milk output.

• 2030–2035: Sales climb from USD 96.6M → USD 120.5M, representing 54.5% of growth

Growth accelerates as advanced drying and pelletizing technologies enable longer shelf life and consistent quality.

Between 2020 and 2025, beet pulp sales rose steadily from USD 66.8M → USD 83M, demonstrating a market that has moved from treating beet pulp as a disposal challenge to a value-added commercial feed ingredient.

Why Demand Is Rising

Livestock producers are choosing beet pulp because it delivers:

• High digestible fiber for rumen health

• Palatability and balanced energy without risk of acidosis

• Measurable sustainability advantages through upcycled sugar byproducts

The EU’s regulatory push for reduced carbon footprint feed ingredients is strengthening adoption. Scientific evaluations further confirm beet pulp’s benefits across dairy, equine, and small ruminant feeding systems, leading feed formulators to include it in nutrition plans.

Segment Analysis

By Product Type: Dried Pulp Leads with 45.6% Share

Dried pulp (pellets and shreds) dominates usage and is expected to rise to 47.6% share by 2035.

Key advantages include:

• Long shelf stability & year-round inventory control

• Efficient handling and bulk transport

• Consistent nutritional value

By Application: Cow Feed Generates 56.0% of Total Demand

Dairy operations rely on beet pulp to enhance fiber intake, improve rumen efficiency, and support milk production.

Drivers include:

• Proven milk yield optimization

• Better feed intake due to higher palatability

• Competitive cost compared to soy hulls and other fiber sources

By Distribution Channel: Modern Trade Holds 35% Market Share

Agricultural cooperatives and feed wholesalers remain the primary distributors.

Online sales are expected to increase from 15% to 20% share as farmers adopt direct-to-farm purchasing.

By Nature: Molassed Beet Pulp Leads with 55.0% Share

Molassed beet pulp improves:

• Palatability

• Energy density

• Pellet durability

Country-Level Insights

Country CAGR (2025–2035)

Germany 4.3%

Netherlands 4.1%

France 3.7%

Rest of Europe 3.6%

• Germany leads EU sales, growing from USD 28.1M → USD 42.6M by 2035 due to large dairy herds and sophisticated feed production.

• France rises from USD 23.8M → USD 34.2M, driven by strong agricultural cooperatives.

• Netherlands, despite its small size, posts aggressive growth thanks to intensive livestock systems.

Competitive Landscape

The market remains moderately fragmented, led by sugar processors and feed cooperatives investing in pelletization, drying technology, and fortified pulp formulations.

Leading players include:

• Tereos (22% share)

• Nordzucker AG (20% share)

• Südzucker AG

• Cristal Union

• Pfeifer & Langen

• Cosun Beet Company

Companies are moving toward fortified beet pulp products (vitamin/mineral-enhanced), sustainability certifications, and carbon-tracked sourcing.

Conclusion

With rising pressure for sustainable, cost-efficient animal feed and the EU’s circular economy policies, beet pulp is transitioning from a sugar byproduct into a strategic feed ingredient. As livestock producers seek consistent fiber sources and lower carbon impacts, beet pulp is positioned to capture strong demand momentum through 2035.

Stay Ahead With Data-Backed Decisions. Gain Preview Access to Methodology, Sample Charts, and Key Findings by Requesting Your Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27119

For Customized Insights And Licensing Options, Get The Full Report. Purchase Full Report. https://www.futuremarketinsights.com/checkout/27119

Browse Related Insights

Beet Pulp Market: https://www.futuremarketinsights.com/reports/beet-pulp-market

Beet Sugar Market: https://www.futuremarketinsights.com/reports/beet-sugar-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.